|

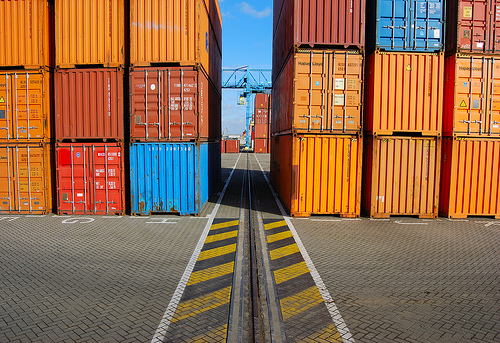

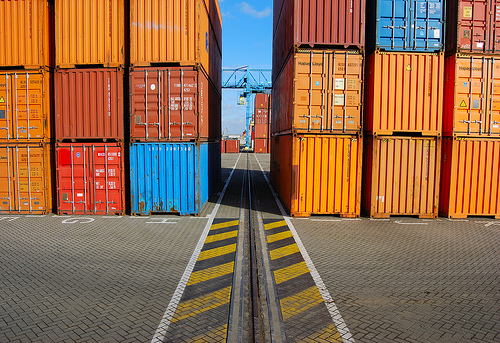

| Picture Credit: flickr.com/lightmash |

With international trade, financial transfers, and foreign direct investment, the economy is increasingly internationally interconnected. This page analyzes economic globalization, and examines how it might be resisted or regulated in order to promote sustainable development.

Articles and Documents

2013 l 2012|2011 |2010 | 2009 | 2008 | 2007 | 2006 | 2005 | Archived Articles

2013

China’s involvement in Africa over recent years has been the subject of much scholarly and journalistic debate. Policymakers and observers have also devoted increasing attention to the emergence of multilateral cooperation between the world’s emerging economies, often abbreviated as the BRICS (Brazil, Russia, India, China, and South Africa). Some are convinced that these developments are establishing auspicious conditions for significant progress and development in Africa. Henning Melber, however, cautions against excessive optimism,noting the self-interested nature of Chinese investment. Although curent international trends may provide opportunities for Africa, Melber argues that Africa’s future is uncertain and depends on its states, leaders, and social struggles.

2012

The eurozone crisis has reduced foreign aid, remittances, tourists and the demand for African exports. But the overall economic growth and investment trends are positive—some countries will benefit from the exchange rate changes and the rise in commodity prices such as gold. The eurozone crisis has blurred the distinction between “high risk” emerging economies and the “safety” zones of Europe and the US; “today, the rich world offers low growth and high risk.” As South-South foreign direct investment proved to be more resilient to global shocks, African economies can take this crisis as an opportunity to diversify their trade and create a new economic order. (This Is Africa)

Allegations of a 2008 London derivatives scandal are currently being pursued. Investigators believe that an attempt may have been made to manipulate prices in the unregulated London Credit Derivatives Market at the height of the banking crisis in 2008. Surprisingly, investigators are not British officials, but prosecutors from Iceland. UK authorities that had previously examined the case concluded that, despite sound evidence, a criminal prosecution would be “costly and untriable” due to the complex financial instruments involved. The fact that UK authorities admit to be defeated by the complexity of this case is a damning indictment of authorities power to regulate financial markets and hold them accountable. (Guardian)

The Guardian blog Going native in the World of Finance aims at making the complex world of finance accessible to outsiders. In this week’s post a former treasurer at a collapsed bank presents his answer to the question of why virtually nobody inside the finance world speaks out against the banks’ practices. The problem, the banker maintains, lies in the incentive structure, which ranges far beyond large bonuses. “It is about tribal bonding, about belonging and sticking with your mates.” In an environment that follows the principle “either with us or against us,” regulation to keep the institutions in check will not work. “Don’t hold your breath. No matter what rules you out in place, they’ll always find ways around it.” For this system to ever get truly better “you’d have to untangle the inherent tendency to amorality.” (Guardian)

Over the past three decades the financial system has exploded in size and importance. Markets now act as the central hub of an exploitative system that demands unlimited economic growth, stretching people and planet to a breaking point. Rather than losing strength after a financial crisis that sparked economic instability and recession across the globe, the power of financial institutions has only increased since 2008. Yet, despite its social importance, the financial system appears incomprehensible for the vast majority of citizens. This booklet published by Corporate Watch aims at contributing to a popular understanding of the banking and finance sector and its vast role in society. (Corporate Watch)

Four decades of financial liberalisation have left countries defenseless against pernicious financial flows and a powerful and highly speculative financial sector, shifting the balance of power from governments to markets. In this report, the European Network on Debt and Development proposes concrete solutions to (i) reach macroeconomic and financial stability, (ii) stop food speculation and (iii) curb illicit financial flows facilitated by tax havens. According to the report, “these difficult times also provide a golden opportunity to re-regulate the financial system, and change the development model.” It is time for the big financial casino to be closed for good. (Eurodad)

The United Nations is predicting the arrival of the one billionth tourist in November or December of this year. Responsible for five percent of the world’s GDP and highly significant in 11 out of the 12 countries that hold 80 percent of the world's poorest, the tourism industry has come to represent something of a panacea, a road for shared socio-economic development. This IPS article presents the upsides of the tourism industry. However, the article points out that “the true success of travel marketing is not the numbers of tourists arriving at a destination, but in the earnings that tourism generates for the national exchequer.” For tourism to serve as an agent for broader socio-economic development, services and goods ought to be delivered by local providers and intersectoral linkages between the tourist industry and other economic sectors of the host-country need to be promoted. (Inter Press Service)

In an attempt to take advantage of low wages and expanding markets, multinational companies have shifted manufacturing operations and research from North America and Europe to Asia. Taking the French manufacturing industry as its case study, this YaleGlobal series offers ideas on how nations can design their policies to benefit from globalization. The first article examines how the lack of international market regulations leads to an uneven distribution of jobs. Economist Pierre-Noel Giraud argues that wealthy countries should keep their boarders open and emerging counties should continue developing their domestic markets. The second article explores the promotion of labels that identify a product’s country of origin as a way to prevent the loss of manufacturing jobs. Author Alain Renaudin maintains that geographical labels are no solution, as values, expertise and innovation are more critical factors for economic success. (YaleGlobal)

In the recently launched Guardian blog “Going native in the World of Finance,” Dutch anthropologist Joris Luyendijk explores the world of finance from the inside. By interviewing bankers, traders and financiers, he seeks to make the complex world of finance accessible to outsiders. In this piece, Luyendijk meets a UK math student who is trying to get an internship in the banking sector. He is skeptical about the industry, fears that the financial sector attracts the best minds, and yet chooses to go into finance. This Guardian interview tries to explain why, illuminating the systemic issues underlying the student’s choice. (Guardian)

Having a good command of the language of economics seems indispensable in today’s political climate. Even with a basic understanding of standard economic vocabulary, however, it is easy to feel disempowered by “an economic argument.” Politicians and pundits use seemingly authoritative arguments to quash criticism. Oftentimes though, economic arguments that seem very powerful at first are not more than hot air. In this blog entry cited by New York Times columnist Paul Krugman, Noah Smith outlines a list of seven of these fallacious arguments and presents easy responses to debunk them.

Ian Bremmer, founding president of Eurasia Group risk consultants outlines what he believes to be the top risks and ethical decisions for 2012. Bremmer argues that the lack of global leadership represents the greatest threat for 2012. At a time in which states and markets are becoming much more interlinked and in which economic rather than security issues are driving national politics, “private sectors ought not to capture the state.” (Policy Innovations)

2011

According to Professor Charles Kupchan of Georgetown University, the idea that globalization would be particularly advantageous for Western liberal societies was flawed from the get-go. Governments falsely assumed the lasting efficacy of traditional policy tools and lost sight of democracy and solidarity. Western economic and democratic malaise can only be overcome if inequality is redressed and popular control of the political economy is bolstered. Rather than seeing these conditions as valuable in themselves, however, Kupchan thinks that they are instrumentally valuable to avert geopolitical threats to the West’s “material dominance” and “ideological primacy.” Instead of questioning neo-liberal globalization itself, Kupchan merely criticizes the West’s ability to take advantage of it. (New York Times)

In the wake of the financial collapse of 2008 and at a time of vast economic uncertainty, the role of cross-border capital flows ought to be questioned. There is considerable consensus in the economic literature that countries with deregulated and liberalized policies towards capital inflows do worst when a crisis hits. However, despite the grave risks involved in not regulating financial flows, an overarching global framework to regulate and control capital flows does not exist. This report of the Bretton Woods Project explains the drawbacks of policies that deregulate the movement of money across borders and makes concrete suggestions to regulate financial flows to ensure stability and development. (Bretton Woods Project)

According to demographer Danny Dorling, recent world population projections such as those by the UN Population Fund (UNFPA), are overstated. Rather than continued exponential growth towards unsustainable levels, Dorling expects a point of “peak population”, after which the world population will drop. Additionally, Dorling notes that inequality between countries (not necessarily within them) appears to be declining. One of the possible positive effects of these trends is that restrictive migratory policies will become a thing of the past. Many people will no longer have the need to migrate, and the freedom of movement across borders can be democratized. (openDemocracy)

Every year more than 100,000 Filipinos go abroad to work in the service industry - 22% of the working age population. Many of those are maids, sent all over the world into domestic service to support their children back home. With the “supermaid” program launched in 2006 by former president Gloria Arroyo, the Philippines government aimed at training domestic servants, doing away with agency fees, ensuring a $400 minimum wage and reducing the structural violence affecting women. Five years after the programs establishment, there are training colleges all over the country, but the promise of basic rights for Filipino overseas workers has proven empty. “Every day the bodies of six to ten Filipinos who have died working overseas are repatriated. The Philippines has become a factory producing workers.”(Monde diplomatique)

Recent events in North of Africa serve as a crucial reminder that public opinion can influence government decisions. A united global public can force governments to reorder their distorted priorities. Prevention of up to 50,000 poverty-related deaths each day is sufficient reason for prioritizing an international program of emergency relief above all other international concerns. This ought to be followed by longer-term global economic reforms. Sustainable models for development must come from within developing countries. The UN must establish a more inclusive international framework, which fully recognizes our global interdependence. “The time to act is now.” (

Share the World’s Resources)

Crises will continue to persist as long as responses to current interrelated crises remain anchored in mainstream economics and ecological modernization, Growth continues to be perceived as the only measure of development; environment and ecosystems continue to be perceived as unlimited. Fashionable “green turns,” such as green economy, green growth or sustainable growth will not do the trick. Instead of focusing on means such as efficiency and technological innovation, policymakers should realize that the main driver of the crises lies in the end goal of unlimited growth. (Open Democracy)

Stewart Wallis, executive director of the New Economics Foundation, identifies four interlinked problems in our contemporary global economy: it is Unsustainable, Unfair, Unstable, and it’s making individuals Unhappy. These systemic problems are, however, not only extremely dangerous, but also completely avoidable. Humans are not necessarily stuck with the economic construct they created. To solve “the four U’s,” policy makers need to rethink most of our economic orthodoxy. Rather than asking how GDP can be maximized, the new economic question is “how much well-being can be achieved for each unit of natural resources?” (Yale Global)

In his new book The Globalization Paradox, author Dani Rodrik puts forth several principles he feels are necessary to create a sound global economy in today’s world. Rodik believes markets must be strengthened by social institutions, such as courts, in order for society to effectively enforce legal policies. Furthermore, the nation state, rather than transnational institutions, should be central in the deisgn of economic policy. According to Rodrik, a good global economic structure should be based on the assumption that “globazation works best when it is not pushed too far.” (Project Syndicate)

Market liquidity can vanish in the blink of an eye due to the proliferation of advanced high-frequency trading platforms, which are able to execute thousands of trades a second. When liquidity begins to disappear, it can create a cascade effect where other algorithmic traders automatically sell positions, precipitating a market crash. Market crashes present a challenge for regulators looking to solve abrupt market disruptions. Unfortunately, regulators have been slow to react to a glaring gap in oversight which poses systemic risks to capital markets. (New York Times)

Enterprising Gazans have turned to constructing tunnels to move goods into the territory. Israel has since 2008, instituted a virtual blockade of the territory. But, like any situation where goods are outlawed or taxed, supply is reduced while demand increases, and that provides an irresistible opportunity for risk-taking entrepreneurs. Growing profits will continue to entice Gazans to join the illicit economy, further driving tunnelnomics. (Foreign Policy)

Developing and developed nations alike are feeling the impact of rising world food prices. Contributing factors include extreme weather events, speculation on food prices and subsidies diverting food for the production of biofuel. Rising food prices affect poorer countries disproportionately and sometimes result in political instability. This article argues that research and technology advances in agriculture can only sustain a growing population for a limited period, and that a failure to address the needs of the poor could threaten global security. (Yale Global Online Magazine)

Developing nations are confronting trillions of dollars in illicit outflows from trade mispricing, crime, and corruption. Global Financial Integrity, a Washington-based research group, determined that from 2000 to 2008 over $6.5 trillion was drained in this way from developing economies. China led all nations in illicit outflows. (The Wall Street Journal)

The Economics of Happiness, a newly released documentary, offers a critique of the negative effects globalization on people's lives. The film notes that despite the rise of material wealth over the past 60 years, studies show that people are less happy. Climate change, growing insecurity, and exploitation of dwindling natural resources emerge as byproducts of the unrelenting push of global capital. The filmmakers advocate a return to localized production of goods and services, with a greater emphasis placed on shared community resources, in order to escape the juggernaut of the current system. (

Alternet)

"Hot money," or speculative flows of funds which rush into countries to exploit favorable interest rates, are flooding into emerging markets, leading to major imbalances in the global economy. Some countries have begun to institute capital controls in an effort to keep their currencies from appreciating too quickly relative to the dollar, and maintain export competitiveness. Emerging market policy makers have defended their use of capital controls to ward off dangerous speculation. (The Wall Street Journal)

2010

Last decade, the term BRIC (Brazil, Russia, India and China) was used to refer to emerging markets with high growth potential. In 2010, six more countries have been included in the rank of these emerging markets, and the group has been designated as CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa). Emerging markets are expected to grow three times faster than developed countries this year and are driving global recovery.

Greece will receive a $40 billion rescue package in what is potentially the biggest bail-out of a country ever. Two-thirds of the rescue packagewill come from EU member states, and one-third from the IMF. The deal is expected to go through by early May once discussions over the conditions of the rescue package conclude. What does this bail-out mean for the European monetary union? Critics have come to question how a eurozone member was able to accrue such a proportionally large public debt. Obviously, there was a critical lack of oversight, obligation, and assistance in existing treaties. (

BBC)

President Obama's push for tough bank regulation is not only opposed by Wall Street, but by international regulators as well. Ministers of the G20, the President of the IMF, and other big bank representatives voiced their concerns at the recent World Economic Forum - that such an action would create "regulatory confusion" and form a barrier to international coordination. Also, they said nation-specific financial regulation would require cross-border controls to ensure banks do not deviate from legislation, which would be costly. But Dani Rodrik argues that regulatory diversity is the only way to ensure democratic accountability, and it would empower domestic legislatures to respond to their domestic environment - which wouldn't be a bad thing. (The Business Standard)

A Canadian Mining company, Pacific Rim, has filed a claim to sue the Government of El Salvador under a provision in the Central American Free Trade Agreement. Ironically, Canada is not even a party to the agreement. In 2009, El Salvador refused PacRim's environmental impact statement denying the company the opportunity to mine for gold. PacRim now seeks $100 million, double what El Salvador receives in US foreign aid, using its American subsidiary to take El Salvador to an arbitration panel at the World Bank. Critics argue that investment rules should allow nations the flexibility to protect their environment. If instead, investment groups can sue to override domestic laws, sovereignty has little meaning.(The Guardian)

Under the terms of the Lisbon Treaty, the European Parliament can decide whether or not to share EU bank transfer information with the US. US Treasury Department official, Adam Szubin, is pushing hard to convince the EU to go ahead with information sharing previously agreed. US National Security Advisor, James Jones, has also said that transparency in trans-Atlantic transfer data have prevented and will prevent terrorist attacks. (Der Spiegel)

The world economic crisis has changed the dynamics of globalization. Outsourcing has lost its efficiency and nations prefer local initiatives to lower costs. Emerging countries such as China want to secure long-term access to raw materials. The "middleman" concept might disappear as end-point retailers contact primary producers directly. (World Politics Review)

The World Bank chief economist Justin Lin explains why countries should diversify their industries if they want to keep pace with the global economy. Referring to India and China, Lin argues that nurturing industries in line with national advantages such as cheap labor and rich natural resources, developing countries can adjust to post-crisis economy dynamics. Governments' capacity in taking countercyclical measures plays an important role as well. (The Times of India)

Since the US abandoned the gold standard in 1971, the global monetary system has relied on a dominant faith in the US dollar. José Ocampo argues that this system must be reformed. He points to the flaws of the current system in which all currency values are relative and unstable. This puts low and middle income countries with heavy debt-burdens at a serious disadvantage. Ocampo mentions four possible solutions and discusses two that the G20 might consider. (Friedrich Ebert Foundation)

The Mercosur trade bloc (Southern Common Market) is in danger of disintegration as cheap Chinese products are taking hold of the trade markets in South America. In 2008, Brazil's exports to Argentina and Uruguay shrank by 45 percent. Last week, the Brazilian government announced a two percent tax on foreign investment as a measure to stem the rise of the Brazilian currency that is partly responsible for the trade problem. Still, Brazilian businessmen advocate for a stronger mesaure to address the Chinese challenge. (Terraviva Europe)

Jagdish Bhagwati, former advisor to the UN on globalization issues, holds "Wall Street Treasury Complex" responsible for the financial crisis. According to Bhagwati, the solution lies in taxation on abnormal profits of big investment banks. A professor at Columbia University, Bhagwati suggests an international board with credibility and independence under the name of "World Risk Assessment Board." (Financial Post)

Globalization of the world economies enabled the big expansion in global financial assets and increased global financial integration. This caused the state's role to shrink in financial systems, particularly in developed countries. Today, global financial institutions fail to meet the challenges posed by the present crisis. This makes it harder for states to recover their economic growth and overall welfare. (Livemint)

Globalization made the world economy interconnected and interdependent. Now, the financial crisis raises the question whether we will see a reversal of global economic integration. Decreased trade flows and a rise in tariffs show the vulnerability of economic globalization. Policies for the prevention of future economic crisis must take these factors into account.(Harvard Business)

Brussels is working on a new set of rules to strengthen regulation of hedge funds and private equity firms operating within the European Union. The framework, requiring European investors to register with EU authorities, could have major implications for Western economies. Conservative voices threaten that such a law would harm financial firms and lead to an exodus. (Sipegel International)

The globalized economy involves "everyone, everywhere and everything" but at present we witness a world economy divided into regions - NAFTA, the EU, MERCOSUR and ASEAN. Economic activity takes place within these regions, not among them, and these forms of regional economic activity date back to antiquity. This article argues that by linking globalization to history, new paths to development and economic growth can be revealed. (The Globalist)

The editor of Share the World's Resources outlines the academic debate on globalization and argues that over-simplistic framing of the theory has polarized globalization as "good" or "bad". He states that we cannot blame globalization for the economic crisis, but rather "bad economics" and a lack of understanding of international trade. The crisis presents a turning point for globalization. Re-designing institutional structures, founded upon bottom-up participation, could create fairer opportunities to re-distribute the benefits of globalization more equally. Skeptics must move beyond their opposition to free-market principles, and seek a new global trading system, one which balances protectionism and liberalization.

As Asia's once booming export-led industrialization faces severe decline, Walden Bello warns of the rising protests and potential resurgence of social revolution across Asia. He examines the illusion of "decoupling" – Asia's supposed immunity to economic downturn and financial crisis arising in the West. This article argues that the US credit crunch brings an end to Asia's prosperous export era since economic growth in this region is based on complex export chains: China assembles parts imported from other Asian countries, which it then exports to the West. Thus, China's consumer-goods industry depends upon demand from US and Western Europe, which in turn, relies upon the availability of credit in the West.(Foreign Policy in Focus)

Policymakers at the 2009 World Economic Forum in Davos acknowledged the need to re-direct economic policy away from American-style, capitalist globalization and pointed to market failure as a major cause of this crisis. Blaming American financiers for their irresponsible behavior, which helped spread instability and risk to poorer countries, Joseph Stiglitz reflects on the role of the US in future global economic policy. As confidence in the US declines rapidly, and world economic prospects look bleak, Stiglitz asks whether the US will continue to take the lead in global economic policy, this time setting an example of heavy protectionism.(Guardian)

We should critically examine the globalization of the world economy and its impact on prosperity over the past thirty years. A UN study shows that poverty increased almost as much in countries that remained disconnected from the world economy as in those which fully liberalized their markets. The author challenges the pro-liberalization scare tactics of Gordon Brown, which imply that a move away from a liberalized economy automatically entails a retreat to extreme protectionism and autarky. Globalization has led to increased instability, and world leaders must acknowledge its detrimental impact, which hits the poorest countries hardest. (Guardian)

The G20, the world's twenty leading countries, should not decide on global economic politics on behalf of the entire world population. Civil society organizations argue that all governments and civilians must collaborate to build a new set of principles that strengthen national and local economies. For instance, governments should renegotiate free trade agreements, control capital flows, call for debt cancellation and close tax havens. (Choike)

The neoliberal promise of market-led "economic freedom" has not brought wealth and economic freedom for everyone. Twenty percent of the world's citizens consume more than eighty percent of the world's goods. Without resources such as education and food security, the majority of the world's population has fewer possibilities to improve their situation. (Share the World's Resources)

This article argues that the financial crisis provides an opportunity for world leaders to review their political performance. They can continue to rely on a "self-regulating" market, which caused the crisis. Or they can put forward a new agenda for food security and redistribution of the world's resources. (Share the World's Resources)

In this article, Walden Bello analyzes the history of finance-driven capitalism and argues that overproduction, greed and speculation are key factors behind financial crises. Neoliberal economic policy produces speculative bubbles with short-term profits for very few actors. The author warns that the collapse on Wall Street will spread and translate into an Asian recession. (Foreign Policy in Focus)

Rising fuel prices are forcing companies to rethink their production. Instead of outsourcing manufacturing, companies like IKEA are opening factories closer to consumers. Many experts are also concerned about the environmental impact of the emissions-intensive model that involves far-reaching supply chains. Economists dispute whether rising oil prices will have asignificant impact on global trade. Some say that globalization trends will reverse, while others argue that companies consider factors other than transport costs, including exchange rates and labor costs. (New York Times)

Dani Rodrik reminds us of the collapse of global markets in the 1930s and asks whether we are likely to see a similar "death" of globalization. Global markets are heavily interdependent, yet regulatory institutions and other governance systems do not exist at the global level. The time has come to create new institutions and compensation schemes, to make globalization fairer and more sustainable.(Project Syndicate)

Increasingly, the public, economists and development analysts are questioning whether globalization has delivered on its "promised benefits." Various reports show a trend of increased inequality in the world, between the North and the South, but also within both poor and rich nations. The author concludes that a tiny group at the top of global society reaps the rewards of globalization, while the vast majority of people miss out. He supports drastic re-distribution from the top down, such as increasing income tax for top earners, and eliminating income tax for those earning less than a given average national income. (World Economy & Development in Brief)

Increasingly, the public, economists and development analysts are questioning whether globalization has delivered on its "promised benefits." Various reports show a trend of increased inequality in the world, between the North and the South, but also within both poor and rich nations. The author concludes that a tiny group at the top of global society reaps the rewards of globalization, while the vast majority of people miss out. He supports drastic re-distribution from the top down, such as increasing income tax for top earners, and eliminating income tax for those earning less than a given average national income. (World Economy & Development in Brief)

Global income inequality between rich and poor countries is decreasing says Inter Press Service. The UN Conference on Trade and Development (UNCTAD) reports that real per capita incomes are on average 18 times higher in richer nations than poorer nations, compared to 24 times higher in 1980. But, this data fails to explain why poverty and hunger are increasing worldwide. In fact, economic inequality within richer and poorer nations has also increased markedly, leading to violent protests in India and large-scale demonstrations in China.

Political scientist Susan George argues that "corporate-led, finance-driven globalization" has led to huge and ever increasing inequality. Globalization has been good to those in the tops of societies, but the system as a whole faces crisis: The World Trade Organization finds itself in deadlock, and institutions such as the World Bank are less important than before. George argues that scarcity of food and water, climate change, and the risk of an economic recession will place further, extreme stress on the world system and will lead to increased violent conflict. (Transnational Institute)

The international polling firm GlobeScan conducted this poll for the BBC World Service, in order to document attitudes towards globalization and the global economy. According to GlobeScan President Doug Miller, the results illustrate that "there is real public unease about the direction of the economy, but it's not only about a downturn. It also has to do with how fairly benefits and burdens are shared, and the pace of globalization."

Immanuel Wallerstein argues that in the global economic system, two main ideologies have always been "cyclically in fashion"- neoliberalism and Keynesian thinking. He argues that neoliberalism and the unrestrained market system it advocates have led to global financial turmoil. Consequently, the public and economic policy makers are moving back towards Keynesian and more socialist thinking. Wallerstein asks whether this shift in ideology will be able to restore economic order despite the damage done by neoliberal policies. (Yale Global)

According to Nobel laureate and economist Joseph Stiglitz, globalization can have a positive outcome, but only if developing countries are able to "take advantage of globalization, rather than be taken advantage of." He points out that India and China have resisted US pressure for neoliberal reforms such as the privatization of state assets and have created "stronger societies" by doing so. (New Statesman)

This World Economy and Development article examines how institutions that traditionally championed unregulated globalization are now taking a more critical approach. The International Monetary Fund holds financial globalization responsible for increased income inequality over the last two decades, while conservative newspapers such as the Wall Street Journal and the Financial Times have started looking at "how the other half lives."

In response to growing economic globalization, more integrated global markets and international production systems, trade unions across the globe are joining forces. The unions increasingly coordinate their work to advocate international labor standards and rules of conduct for transnational companies. They encourage national governments to secure "proper regulation, taxation and transparency" for private sectors. (World Economy and Development)

The author of this openDemocracy article is excited about the revival of the Club of Rome, a group of academics, bankers, development specialist, and former ambassadors and foreign ministers who meet to discuss development policy. The members of the group have expressed concern about the unfair international trade system, insufficient measures taken to reduce climate change and governments' excessive security and military spending. They call attention to the "real understanding of the underlying causes of insecurity," such as the unequal access to resources. The author suggests that the ideas of the elite group have great potential and its resurgence signals progress for reforming globalization.

This article addresses issues of "economic nationalism," a sentiment that appears to be growing in the US. Globalization opponents argue that economic independence is vital for national security. Critics disagree and say that security increases when a country can draw resources from a wide range of sources. Interdependence and integration in global markets promote peace, not conflict, they argue. (International Herald Tribune)

The Asian continent has experienced increasing economic inequality over the last two decades. Critics suggest increased exposure to international market is to blame. On the other hand, the author of this YaleGlobal article argues that the expansion of industrialization in countries such as China and India has created many jobs and lifted a lot of people out of poverty. But, in both countries poverty declined prior to economic liberalization. The author argues that the Indian and Chinese case studies alone cannot illustrate whether globalization causes inequality or the other way around.

This AlterNet article explores the relationship between international trade and conflict. The author finds that high levels of trade acts as an accelerator for either cooperation or conflict. Whether cooperation or conflict occurs, depends on the structure of a country's domestic economic institutions and which domestic sectors are dominant in international exchange - primary, industrial, or even military products. The author also argues that trade can promote cooperation if the political elite are affiliated with productive and competitive industries or alternatively whether the elite are involved in industries less successful in international trade. The author warns against viewing trade and economic independence as a protection against war or conflict.

Rich countries have long been preaching to their poorer partners about the supposed benefits of economic globalization. They have argued that economic growth can only be achieved through open markets and free trade. Some developing countries such as China and India have listened to the suggestions and actually achieved substantial growth and global competitiveness. With the increased influence of these emerging economies, rich countries are experiencing many of the negative effects following global economic integration. In the US, protests against outsourcing, foreign investment and increasing income inequality are growing and politicians skeptical of globalization capture larger shares of the public vote. (YaleGlobal)

This article from the Inquirer gives a detailed analysis of the trends in international economic policy following the neo-liberal Washington Consensus. The discussion covers the World Bank's Poverty Reduction Strategy Papers, neo-liberalism and neo-structuralism. The article also looks at "global social democracy" as represented by economists Jeffrey Sachs and Joseph Stiglitz, a take on global economics that values equity before growth. Although this view is a radical departure from the original Washington Consensus, Sachs and Stiglitz still argue that economic globalization can bring benefits. The author argues that globalization as the most recent stage of capitalism is merely an attempt by capitalists to overcome their "crisis of overaccumulation, overproduction and stagnation," that does not benefit the poor countries.

This Globalist article compares the US and Chinese economies following decades of economic globalization. The two countries are experiencing equally worrisome levels of income inequality and turbulence in their financial markets. This has caused fear, even among pro-globalization advocates. The author suggests that the global economy is headed towards a rough patch. He does not necessarily advocate for an end to globalization but rather a reform of the nature of globalization as we know it. He predicts that the structure of the global economy will have to change to counter the wide global and national disparities.

This Business Daily Africa article discusses Professor Dani Rodrik's paper "How to Save Globalization from its Cheerleaders." Rodrik criticizes the "new conventional wisdom," which insists that only through further trade liberalization will people in both rich and poor countries benefit from globalization.Globalization has not provided the benefits its "cheerleaders" promote. Governments still restrict the movement of labor between countries – an area which if opened up has huge potential economic benefits. Rodrik suggests that in order to better reap the benefits of economic globalization there must be "legal, institutional, [and] political integration."

The leaders of six East African countries, Uganda, Rwanda, Burundi, Kenya, Tanzania and Zanzibar, met to decide whether by 2012 East Africa will have a single currency and a common market, which will allow the free movement of people. Kenya and Uganda demonstrated great support for fast-tracking the East Africa political federation, whose goal is to have a federal president and parliament by 2013. Tanzania on the other hand is concerned that a federation may threaten its sovereignty and security and lead to corruption. (New Vision)

An estimated 2.7 billion people live on less than US$2 a day, while the number of millionaires has increased 80 times since the 1980s. Within the globalized world, power has moved away from governments to large transnational corporations and global institutions. Corporate led economic growth and free trade leads to environmental degradation, growing inequalities and resource depletion. The authors advocate a principle of sharing, in which decision makers acknowledge universal access to resources such as food, water, shelter and medicine. (Share The World's Resources)

UN Secretary General Ban Ki-Moon argues that whereas the first stage of globalization benefited mainly rich countries, the second and current stage "the Age of Mobility" of people, also brings riches to the poor. In 2006, migrants sent $264 billion – "triple all international aid combined" – in remittances to their home countries. Still, Ban argues, migration has so far mostly "benefited richer countries and generated worries about brain drain in poorer ones."(The Washington Times)

The migration of low-skill service industry jobs to developing countries has become a common practice for many transnational corporations. However, this International Herald Tribune article reports that an increasing number are also outsourcing jobs in fields "which once epitomized the competitiveness of Western economies," such as aeronautical engineering, investment banking and drug research. Although some analysts argue that "the US will progressively become less predominant for US corporations," economists predict that this shift will rather encourage the growth of professions in the West "that must be rendered in person," like the police or clinical medicine.

This International Herald Tribune article argues that, in addition to causing "a host of other evils," globalization may contribute to increased civil and international conflict. The author cites increased inequality and natural resource shortages as factors of globalization that may "add fuel to war's bonfires."

Although proponents of globalization predicted it would result in a "more equitable world with equal opportunities," global inequality both between and within countries has instead increased. A United Nations senior economist has stated that "full, productive and decent employment"—not economic liberalization—is the only way to effectively reduce poverty and narrow these global income gaps. (UN News)

This Der Spiegel article reports that, without greater international regulation, the collapse of any one hedge fund could devastate the world's financial markets, hinder economic growth, and cause mass international unemployment. German Chancellor Angela Merkel has called for the world's leading industrial countries to discuss increased oversight on the US$1.3 trillion hedge fund industry at the February 10 G8 meeting in Essen, Germany.

Wealthy nations and international economic institutions, such as the IMF, the World Bank, and the WTO, have long promoted foreign financing as the fastest way to stimulate growth in emerging economies. In reality, argues this Project Syndicate article, this financial liberalization has done just the opposite. The surge in capital inflows appreciates the developing country's currency, causing decreased investment and slowing economic growth.

Despite an almost 500 percent growth in the hedge funds market over the past decade, regulation of the high-yield investment companies has remained stagnant. As these financial institutions now account for 18 to 22 percent of all trading volume on the New York Stock Exchange, Randall Dodd, director of Financial Policy Forum, argues that this lack of oversight may pose a serious threat to public interests, especially considering the "fraud, embezzlement, and market trading abuses" historically linked with hedge funds. (Policy Innovations)

In this sixth annual Globalization Index report Foreign Policy and A.T. Kearney rank 62 countries, accounting for 85 percent of the world's population, according to their degree of globalization as measured by 12 variables. The variables fall in the four categories of economic integration, personal contact, technological connectivity, and political engagement, revealing also "the very different ways that countries are opening themselves up." Throughout the report, the authors imply that more globalization is always better. However, despite this clearly positive and seemingly uncritical view of globalization, the report acknowledges that "highly globalized nations spew more carbon dioxide per capita than less globalized countries."

In this Foreign Policy in Focus piece, Walden Bello argues that the economic relations between China and the US chain the global economy together in a "crisis of overproduction." Restrictive Chinese rules on trade and investment force transnational corporations (TNCs) operating in China to locate the majority of their production processes in the country, making the TNCs major "agents of overinvestment." At the same time, Chinese authorities continue exploiting the country's cheap labor by keeping wages down instead of expanding people's purchasing power. Thus impeding domestic consumption, China has chosen breakneck growth feeding the spending appetite of US consumers over domestic and global stability, argues Bello.

Identifying "three rounds of globalization," this Globalist article argues that "globalization is not a new thing." The exchange of ideas between ancient civilizations – the first round – fueled the rise of the West with industrial revolution and imperialism – the second round. Likewise, the transfer of Western ideas feeds the present rise of India and China – the third round. By these dynamics, the world is returning towards global equity, where India and China have a share of world income roughly similar to their share of people – as in the early 19th century. While appreciating this return to international equity as a "moral imperative," the author fails to consider to what extent the economic development of these Asian countries takes place at the expense of domestic equity and the environment.

World leaders increasingly agree on the unsustainable nature of the global financial imbalances represented by an enormous US trade deficit and China's growing trade surplus. Economics professor Joseph Stiglitz appreciates the growing attention given to the problem, but regrets that responses seem to address only symptoms rather than "the larger systemic problem." Stiglitz argues that neither a strengthening of the Chinese Yuan nor a cut in US governmental expenditures alone will solve the problem. Instead, expenditure cuts combined with increased upper-income taxes and reduced lower-income taxes in the US will create the necessary incentives. (New York Times)

In this piece, Randall Dodd of Financial Policy Forum reacts to the "reckless complacency" of a Bank of International Settlements (BIS) senior official, who states that hedge fund operations do not constitute any significant problem in the context of international financial stability. Dodd argues that banks cannot be relied upon to oversee hedge funds in a way that protects public interests, and makes the case for ‘prudential regulation' of hedge funds, ensuring codification of registration, reporting and capital requirements.

Particularly since Chinese President Hu Jintao's visit to Latin America in 2004, relations between China and Latin America have strengthened. The total value of trade between them increased dramatically from US$10 billion in 2000 to US$50 billion in 2005. Similarly, the number of people across Latin America taking Chinese classes has increased substantially, this Washington Post

article reports. With Latin America being the prime destination for Chinese investors, Latin Americans understand the importance of communicating in Mandarin.

Coinciding with the publication of his latest book, "Making Globalization Work," Nobel laureate and former World Bank chief economist Joseph Stiglitz in this Guardian article insists he does not oppose globalization, but rather agrees it "has enormous potential." However, Stiglitz argues that if governments wish to sustain globalization and avoid voters putting a stop to trade, they must manage it properly. Looking to the Scandinavian countries, Stiglitz asserts that by investing in education, research and strong social safety nets, governments can curb rising inequality and create more productive economies with higher living standards for all.

This Council on Hemispheric Affairs report suggests that the resurgence of populism in Latin America diametrically opposes the neoliberal reforms trumpeted by the Washington Consensus in the 1980s. Public figures such as Venezuelan President Hugo Chavez represent the populist wave. Masses rally behind a charismatic leader who addresses their social unrest, denouncing the US and its political and trade policies. The author predicts that this rejection of a universal style of "progress" may increase the prevalence of populism in poorer countries, even if it detracts from formal democracy.

The question of who to blame dominates analyses of the Doha Round collapse. This Common Dreams article instead argues that the underlying cause lies in people's rejection worldwide of the "WTO model of corporate globalization." Trade rules in the "WTO decade" have only benefited a small corporate elite and have constrained domestic policy making. The authors argue for an alternative to corporate globalization and regional trade agreements. They urge US citizens to take action and demand change in their country's position on international trade, as citizens in many other countries have succeeded in doing.

Past World Trade Organization (WTO) rounds have promoted globalization, increasing freer movement of trade and capital. However, in the Doha Round US, EU, and Japanese resistance to globalization dominates. The United States increasingly embraces bilateral trade agreements as poor countries such as China, India, and Brazil gain more clout in the WTO negotiations. The author notes an "unwillingness to make concessions" among rich nations amidst growing fears of growing Chinese economic power. (Guardian)

For two decades, "protagonists" of the Washington Consensus have promised that neoliberal policies would soon make everyone better off. Yet, these policies have failed to reduce hunger, malnutrition and poor health conditions. Inequality keeps rising. Looking at India, the author warns that large inequalities could lead to social unrest that could undermine the very conditions for economic growth in the country. Some Latin American countries, on the other hand, "have begun prospering only after discarding the Washington consensus." (ZNet)

The author argues that US and European moves towards nationalism, or "patriotic globalism," come with more negative consequences than globalization itself. Politicians who feel pressured to choose between the "efficiency imperatives of economic growth" and the "personal security desires of an increasingly frightened and disoriented body public" cannot effectively address the most urgent social and political needs because of a split electorate. Increasingly rigid US immigration bills and the unsatisfying rule of Silvio Berlusconi in Italy demonstrate the harms of decisions made out of fear. (YaleGlobal)

Looking at structures of power and inequality in the world, this preface discusses obstacles to and prospects for achieving global justice. The lack of international democratic processes and institutions greatly impedes global justice, but it conveniently suits the interests of the "present masters of mankind." However, the author argues, great promise lies with the "global justice movement." The author finds encouragement in tendencies such as a growing realization worldwide of neoliberalism's injustices, the increasing ease with which global justice alliances can form, and mounting support for global taxation as a source of funding for development projects. (Transnational Institute)

This World Policy Journal article criticizes Jeffrey Sachs and Thomas Freidman's approach to end poverty, which advocates effective aid and open markets to help poorer nations climb the "development ladder." Donor countries often channel aid in a way that increases income inequalities and, open markets tend to benefit big corporations. To redress this, the alter-globalization movement comprised of farmers, students and environmentalists, promotes development through redistribution of political power and wealth. Contrary to Sachs and Freidman who use monetary values to assess development, the movement uses indicators like democracy, sustainability, food security, and human rights.

In this interview, Harvard economist Kenneth Rogoff warns that the unfair distribution of wealth within most countries will lead to serious social tensions all over the world. As big company profits reach record highs, an ever-smaller percentage of the population gains from high economic growth rates, while most workers see their wages stagnate. As a result, governments could lose public support for policies promoting deregulation of market activities. (Spiegel)

As happened with the "first globalization" and its Wall Street Crash of 1929, an economic rather than a political crisis could reverse today's process of globalization. But this time, the crisis is more likely to errupt from global economy's dependence on transnational corporations (TNCs) than from global financial imbalances. While relying highly on the middle-class consuming their goods, TNCs at the same time undermine middle-class people's ability to consume by moving ever more "white-collar" jobs to poorer countries. (YaleGlobal)

This Third World Network report focuses on the role of the International Financial Institutions (IFIs) and the World Trade Organization (WTO) in causing global economic imbalances. The report critiques IFI policies such as loan conditionality and suggests that the WTO could lessen economic imbalances by addressing commodity prices and supply capacity in poor countries.

This article reviews arguments for and against the idea that globalization has benefited the world's poor over the last few decades. According to Scientific American, the answer is neither a simple yes or no. While the spread of foreign trade and investment has increased work opportunities for many people in poor countries, national political decisions continue to have the biggest influence on poverty levels.

Based on the article

The Sources of Neoliberal Globalization by Jan Aart Scholte, this

South Centre publication offers a historical-sociological background on the neoliberal influence on globalization. It looks at four interrelated forces that have generated and sustained neoliberalism since the late 70s, namely governance, production, knowledge and social networks. Focusing on the exclusive nature of social networks supportive of neoliberalism, the article calls for a broader advocacy of alternative ways to shape globalization.

Many analysts see India as one of globalization's big success stories due to its economic growth rate of 7% in 2005. Nevertheless, many people, especially in the poorer northern regions, can no longer afford their former living standards, since consumer prices grow around 4% every year. With most Indians not educated sufficiently to compete in the new, flexible labor market and with environmental damage on the rise, criticism of India's rapid economic liberalization is getting louder. (Der Spiegel)

This Foreign Policy In Focus policy report describes how globalization impacts the US domestic economy and results in outsourcing of jobs to regions with lower labor standards. The report suggests that the United States create policies and coordinate with other countries to address issues of tax competition, undervalued exchange rates, and productivity. Governments should cooperate on a global scale to create policies that serve the political and social interests of citizens throughout the world, rather than addressing only economic growth.

With a doubling in incomes since the mid-1980s and foreign investment up five times since the mid-1990s, India represents a globalization success story by purely economic measures. But poverty has fallen comparatively slowly and India still has the world's largest population of malnourished people. As in many poor countries, people could benefit much more from globalization if the government would seriously increase spending on education, health care and rural development. (International Herald Tribune)

Many US and European citizens blame globalization for causing economic problems, like poor health care services or high unemployment rates. Although economic liberalization often fails to deliver better living conditions, it is the governments' role to make globalization meet people's needs. With wages in stagnation since 2000 and corporate profits increasing constantly, taxing corporations would be a good first step. (YaleGlobal)

2005

Many people fear that globalization decreases nations' capacities to deal with economic and social challenges. This article argues that the problem is not the global market, but rather the absence of national and international regulation of the market, including of transnational corporations (TNCs). In addition, the author argues that people can exert power over TNCs through their consumption habits. (Der Spiegel)

Neoliberal globalization is failing "to translate into new and better jobs that lead to a reduction in poverty" says a report from the International Labour Organization (ILO). According to ILO's figures, half the world's workers do not enjoy decent work conditions, and cannot lift themselves above the poverty line. The report points out that world leaders have still not made poverty reduction a priority.

The World Bank views Export Processing Zones (EPZ) as an excellent option for poor countries to join the global market. This article describes the conditions of an EPZ on the outskirts of Nairobi, where workers earn three dollars a day without any form of benefits. Rather than liberate people worldwide, the free market has created a new slavery. (Inter Press Service)

Is it possible to trace a parallelism between Colonialism and Neoliberalism, two different forms of domination? The author affirms that phrases like ‘building freedom through trade,' ‘good governance,' ‘working for a world free of poverty' actually hide a new form of imperialism. The World Bank, the International Monetary Fund, the World Trade Organization, and even the UN lead this process of "neoliberal capture." (Toward Freedom)

This Ethical Corporation article examines the "three great waves of globalization" and the role of corporations in shaping human history. "More than any time in history, humankind faces rival and increasingly incompatible viewpoints and realities, with the role of corporations front and centre." World citizens face "two dramatically different roads"— the road that continues the self-serving behavior of global competition for dwindling resources, championed by corporations, and a road that promotes adaptation and rethinking of our lifestyles and corporate behavior to ensure a better tomorrow.

Rather than continue the "race to the bottom" and become the world's "low-cost factory floor," China is eyeing the global market with newfound ambition. While Japanese brands took years to gain global recognition, China is taking a shortcut—through acquisitions and mergers, Chinese companies are obtaining foreign assets and "going global" with the country's own "famous brands." China has fixed its sights on a higher position in the global market. Whether or not this will help the plight of exploited Chinese laborers remains to be seen. (New York Times)

The German workers' quality and expertise are motivating companies to retain production facilities in Germany, despite high labor costs. While Unskilled laborers do most of the production in China and Mexico at a fraction of the cost, some companies like the appliance maker Whirlpool are involved with a "relatively new form of globalization that emphasizes first-rate centers of production and design in various countries - including the United States." This appreciation of workers' quality and expertise is protecting German and US jobs from being outsourced to cheaper labor markets. (New York Times)

In an attempt to cut the ballooning trade deficit, the US administration has been pressing China to revalue its currency. But according to this Boston Globe opinion piece, the real reason behind the trade imbalance does not lie in exchange rates but in the fact that "globalization is broken." Globalization has evolved into a kind of pyramid scheme, in which the US must "consume and borrow ever more while foreign banks buy ever more US Treasuries so their producers can export ever more." Quick fixes like adjusting the exchange rate will not solve the problem; the only way to avoid a global economic crisis is to "insist that the globalization game be played the same way by all its players," the author argues.

In his lecture at Hamilton College, economist Joseph Stiglitz touched upon the asymmetrical nature of globalization. As examples he mentioned rich nations' agricultural subsidies that create an uneven playing field for poor countries' exports, and intellectual property rights that can deprive poor countries of life-saving medicine and technology. Even in the United States that "has benefited enormously from globalization," only some people are experiencing the benefits, Stiglitz noted. (Hamilton College News)

Could the infamous agricultural subsidies actually benefit consumers in poor countries by making food imports cheaper? This is what prominent economists like Jagdish Bhagwati have suggested, but the author of this Dissident Voice article disagrees. Cheaper imported food will not help the three billion farmers in poor countries as long as rich nations' subsidies prevent them from earning enough money to buy the imports, the author argues.

World War I sank "the first age of globalization" by bringing an abrupt end to the preceding period of increasing international trade, investment and migration. Could the rapidly expanding global economy we live in suddenly disintegrate in a similar manner? Pointing out similarities and differences between the present and 1914, this Foreign Affairs article argues that such a scenario is indeed possible, although it is virtually impossible to predict its likelihood.

This paper addresses the consumerist aspects of globalization by examining the links between global consumption, environmental politics and political economy. It argues that consumerism leads to environmental degradation and hinders sustainability. The author also investigates the role of consumption in reproducing global capitalism. (Political Theory Daily Review)

Archived Articles